Is this Eastnine's next deal?

As I stated in my last post, Eastnine is now in an enviable position. Not only are they cash-rich, they are also present in a market where yields are high enough to generate decent returns even on an unlevered basis. Eastnine itself trades at an implied cap rate of about 8%, which is the highest on the Swedish stock market. As it happens, that’s matches the levels at which Baltic Horizon Fund sold its fully let office buildings Duetto I and II (construction years 2017/2018) recently.

Buyer was East Capital Group’s fund Real Estate IV. East Capital, although not formally linked to Eastnine any longer, shares close historical ties with Eastnine. Many of Eastnine’s shareholders are East Capital associates, chief among them Eastnine’s largest shareholder and founder of East Capital, Peter Elam Håkansson. Eastnine’s CEO Kestutis Sasnauskas is also a co-founder of East Capital.

The Duetto deal was struck shortly after the first MFG deal had fallen through for Eastnine, so they were not in a position to buy at that point. Even though Baltic Horizon did complete another sale to an institutional buyer earlier in the year, my hunch is that Eastnine and East Capital are currently pretty alone among prospective buyers in the Baltics. Of the two, Eastnine should be the one with the most financial muscles.

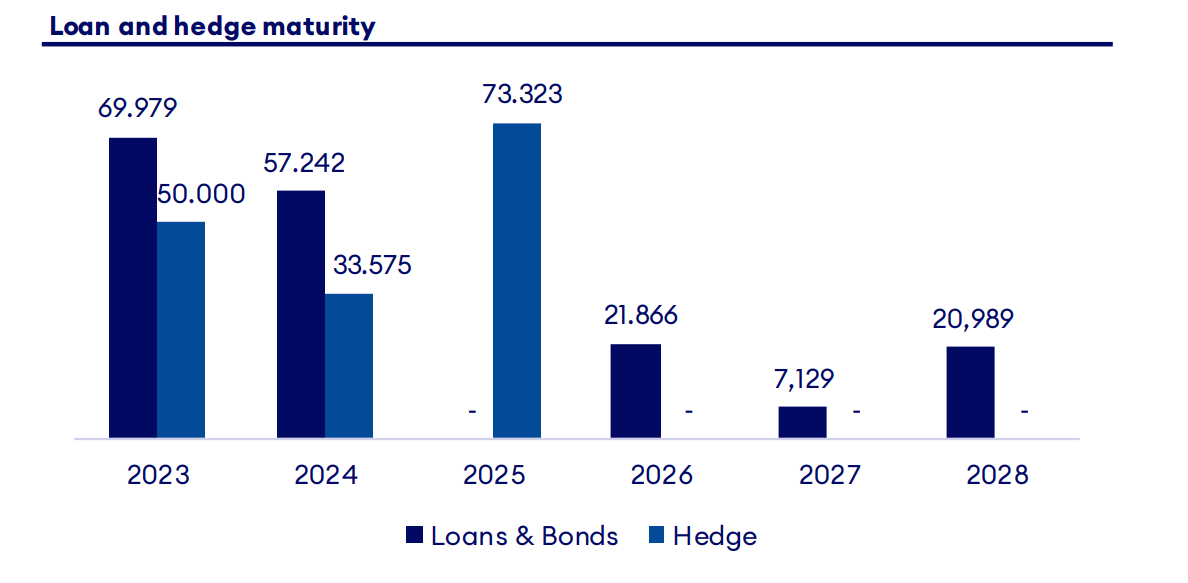

Baltic Horizon on their hand is in forced liquidation mode. They issued a replacement 5-year bond in May of this year for €42m. The interest costs are now absolutely punishing, up from 4.25% fixed on its old series to 8% plus euribor (about 4% on top currently). This is not actually an extraordinary cost of debt for bonds these days, but these bonds are an unusually large part of a heavily geared capital structure. As opposed some other players who have been deleveraging by removing bond financing, it just wasn’t possible for Horizon to pay off the bond at maturity.

Even more significantly, the new bond contains an early redemption clause, obligating the company to pay back €20m within a year. Of that, €7.5m was redeemed after the Duetto sales closed. The LTV was at 60% as of the half-year turn and since then the reported monthly NAV has shrunk somewhat. Further writedowns should be expected in line with the sector. If you do some rough counting on the ICR with the new bond interest on the books, you realize that this can’t possibly be a going concern structure. The bond was rolled because without doing that, full recovery looked exceedingly precarious for the bondholders. With the expensive liquidity buffer of the bond, the fund was granted some time to liquidate.

Additionally, the fund was recently granted a covenant waiver on a bank loan tied to its largest individual property, Galerija Centrs, for breaking the ICR covenant of 1.8x. The waiver is certainly only a temporary reprieve since the debt tied to the property matures in January -24. This maturity represents 19.5% of interest-bearing liabilities.

The fund’s share price has plummeted and is now trading at a 63% discount to NAV. This may not seem extremely out of line with the listed Swedish sector, but you can probably adjust for a few profile low cap rate retail assets which should be relatively liquid with some time to work through auctioning them off. At a glance, Horizon’s office assets, the majority of assets on the book, are marked at similar valuations to Eastnine. They also seem overall of roughly similar quality. What this means is that the implied traded yield reeks of deep financial distress.

Now, why do I go on so much about Baltic Horizon? Well — Eastnine has repeatedly over time talked about 1. growing in size to achieve operational synergies and 2. getting more trading liquidity in the shares and more institutional ownership, both of which matter to index inclusions. On Eastnine’s Q3 conference call, Kestutis mentioned other players having significant maturities. He also said affirmatively that their Eastnine’s next purchase will be in existing markets, immediately ruling out all of Poland except Poznan. When asked — by yours truly — if a portfolio combination with an institutional seller might be in the cards, both presenters answered with a bashful and unison “maybe”. Lady Gaga wouldn’t write a song about Eastnine’s management.

A deal with Baltic Horizon could be a win from all sides. In the marriage of a financially vulnerable and a financially strong player, the strong will always be able to capture value. In this case, however, this value capture doesn’t have to be at the expense of the other stakeholders. Bondholders in Horizon should be glad to be made whole, considering the terms of the May bond. Realistically, they should be satisfied by an early redemption at par from a new owner, even if current terms don’t allow for redemption of the remaining half before 30 months. The banks (shared to a large extent with Eastnine) should be glad to get a more financially stable owner so that they will have less of a headache with waivers and other issues or maybe even getting stuck with properties on their own books.

Even the unit-holders in Horizon can potentially get some equity value out of this, which is looking increasingly less likely to be the case if the fund just keeps liquidating asset by asset. An all or partial stock deal should be able to please all constituents. But unit-holders of Horizon have been caught in a big mess and can’t expect too much. On the Q1 call held by Horizon (the latest one to my knowledge) people were asking about dividends, which at that moment in time could only have sprung from a lack of financial knowledge or deep psychological denial. The unit-holders might need to wake up and smell the coffee.

Of course, it could also be possible to keep making direct transactions, but that leaves the tiny inconvenience of the rapidly melting equity value. So tough choices may have to be made.

Do you think it would be value accretive for Eastnine shareholders to issue shares at the current valuation discount? I guess it would make sense if Baltic Horizon is trading at an even deeper discount. So then you can use the cash to cover the debts.

Also, looking at the properties, seems that some are quite old (https://www.baltichorizon.com/properties/). Well, I guess they can prune some properties after the fact, if it ever happens.

Anyhow, as always, very interesting write up! Cheers!