Jeff Bezos Names the World’s Best Entrepreneur

Discover this SERIAL ACQUIRER, the AMAZON of its niche

Since May this year, TIGO 0.00%↑ has confirmed its astonishing operational turnaround through two strong quarterly reports, revised its guidance upwards multiple times, sold off its towers for a cool billion dollars, announced a game-changing in-market merger in Colombia, reinstated dividends, and relaunched a buyback program for the first time in nearly five years. They’ve also been the target of a takeover attempt.

Stock price performance? Flat.

You probably know that I’m leaving out the finer details here, but when laid out like this you can perhaps see how unusual this situation really is — whether you have followed it for a while or are completely new. Let’s not lose sight of these basics as we dive into the extraneous circumstances.

The lay of the land

In stock market investing, few things are more concerning than an unexplained low price. If you analyze a company, everything checks out, and you have no idea why the price is so low — or why it doesn’t move on good news — alarm bells should ring. If you can’t identify at least one, but preferably several, reasons why the stock is disfavored, you simply haven’t thought hard enough about it. Self-flattering reasons such as “the market is stupid” don’t count. It’s not that the market being wrong is impossible, but starting there is unhelpful and thought-terminating. If your mind goes to clichés like that, or you truly have no clue why something seems “cheap”, chances are high that you are the sucker at the table.

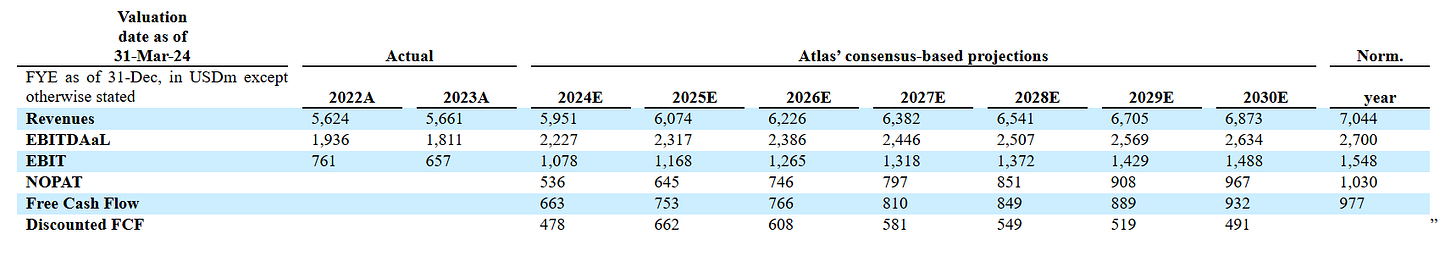

However, this is decidedly not the case with TIGO 0.00%↑ in December 2024 . We know exactly why the price has been stagnant for the past six months. From late May to late August, Xavier Niel’s no-premium bid loomed over the market, anchoring the stock price, which had only just begun to move on improved performance shortly beforehand. Once the bid was finished in early fall, Atlas, the holding company for Xavier Niel’s TIGO 0.00%↑ shares, was moved into Iliad Holding and declared an unrestricted subsidiary, meaning the financing and balance sheets were to be kept separate as to not trigger any debt covenants. We will return to the subject of covenants later, because this is highly relevant.

As minority investors, our focus shifted completely to the tower deal following the bid. That announcement came and went, as did the Q3 report in early November, which included strong hints about upcoming capital returns. Yet, throughout it all, the stock price remained strangely muted.

Then, in a press release at the end of November announcing the resumption of dividends and share repurchases, there was an unwelcome surprise — at least for some — buried among the positives: the SDB trading in Stockholm will be de-listed. This may sound like minor news, but the SDB is, in fact, the primary and original listing, still to this day accounting for a comfortable majority of the traded volume. With the benefit of hindsight—recent price action and a cryptic analyst note suggesting the stock price would remain stagnant for a while—this development was likely not a total shock to all market participants.

Millicom, TIGO 0.00%↑, is a stock with deep Swedish roots, founded by the late legendary entrepreneur Jan Stenbeck. His company, the investment conglomerate Kinnevik, divested its controlling stake in 2019 through a share distribution. Kinnevik, a widely popular stock with broad ownership, left behind a large base of retail money, generally disinterested institutionals and no controlling shareholder after the spinoff.

Here’s a graph of shareholders at Avanza, Sweden’s largest retail broker. See if you can spot the spinoff date…

For over two years, Xavier Niel has been methodically accumulating cheap shares from legacy shareholders. On the whole, it has been easy pickings. We have now entered a new phase of this strategy: forcibly extracting shares from disinterested Swedish institutions and completely inactive retail investors through the de-listing process. It’s quite likely that former chairman Mauricio Ramos would not have supported this move, which may partly explain his abrupt exit at the end of September. The de-listing is currently projected for completion in March next year. How many shares will ultimately need to change hands as a result remains unclear, but so far, trading volume has been elevated, and price action remains weak.

With that background in mind, we, as minority shareholders, are now confronted with two critical questions. First: what are Iliad's strategic plans for the company? Second: can Iliad force out the minority shareholders?

Global ambitions

Let’s begin by trying to suss out what Iliad wants. Iliad’s first foray into international markets was Italy back in 2018. At a parliamentary hearing, Maxime Lombardini had this to say:

Our entry into Italy is more than an opportunity; it aligns with our long-term strategy. Italy is a neighboring market with less advanced infrastructure than France in terms of 4G and fiber. It offers significant growth potential, and we are confident in our ability to replicate our success there. This is not just a one-time move; it is the beginning of a broader internationalization strategy.

The Switzerland operations, which Xavier Niel acquired separately through his holding company NJJ before Iliad entered Italy, also appeared to give valuable information and experience. In an interview with NZZ earlier this year, Xavier Niel had this exchange:

In 2015, you took over the Swiss telecommunications group Salt, then still Orange. What attracted you to enter the Swiss market?

We wanted to offer something that was not available in Switzerland: high quality at low prices. We re-established the Salt brand and built everything from scratch. We were able to offer packages that cost 100 francs at the competition for 39 francs 95. So we put a lot of pressure on prices. Before we came, these were way too high. In fact, Switzerland was the first country in which we fully acquired a provider.

Why did you make this attempt for the first time in Switzerland?

Switzerland was a test laboratory for us, so to speak. The country is stable and well organized, and the tax and legal framework makes it very attractive to buy a company there. So before we went to more difficult countries, such as Bolivia or Guatemala, we first tried Switzerland.

Just to hammer the point home, I will end with a snippet from Xavier Niel’s recent interview book, Une sacrée envie de foutre le bordel.

So the game being played here is one of global expansion. They have a proven growth concept, starting in France and extending to markets such as Italy, Switzerland and Poland. The idea is that their operational edge can scale globally. You could describe them as a compounder and — yes — even a serial acquirer.

What is their secret sauce? I can’t claim to know the complete answer, but here are some operational elements that seem to cross borders: simplified price offers, a strong focus on fixed-mobile convergence, and extreme cost efficiency in both supplies and administrative operations. In France, they have also excelled as marketers. Much of this success hinges on Xavier Niel’s public profile and a brand positioning that combines being the cheapest option with a reputation for tech savviness. Whether that strategy can travel well internationally remains to be seen.

Early American Adventure

Further on the topic of M&A and entering new markets: in 2014, Xavier Niel made an ambitious attempt to take over over T-Mobile TMUS 0.00%↑. It was a massive endeavor, one that even some of his own people doubted at the time. The rationale was that in-market consolidation would not be allowed in the US for competitive reasons. Since Deutsche Telekom, the main shareholder of TMUS 0.00%↑, was assumed to be a seller, Xavier Niel didn’t want to pass up the opportunity. Consequently, he came up with a deal where Iliad stretched to the maximum — including doing a rights offering — to buy a majority of the shares in the company. The bid was completely unsolicited in a way reminiscent of some of the notorious hostile takeovers of the 80s, but it was done with a long-term horizon by an industrial player, albeit one yet to win renown across the Atlantic.

So to be fully clear about the picture here: we are talking about a fully strategic industrial player, who can be extremely ambitious if the opportunity set is attractive.

The TMUS 0.00%↑ deal was bold — and met with disdain from the target. As we all know, TMUS 0.00%↑ went on to perform amazingly well on its own. It eventually merged with Sprint when antitrust sentiment softened. A decade has passed and Xavier Niel has not attempted anything remotely similar in size and scope since, despite Iliad being a much large and more profitable company now.

I was certainly influenced by looking at that deal — and others — to think the TIGO 0.00%↑ story would be a quicker affair overall. Here, instead, the strategy has been slow and methodical. Which makes sense when you think about what TIGO 0.00%↑ was before the French arrived: a management run company with no controlling shareholder, a 100% free float stock and an extremely high squeeze-out threshold of 95%. Additionally, the financing is a further complication which I will get back to shortly.

A good chess player looks at the board before he decides on a move; if the position is closed, he plays positionally and if it is open he looks for decisive tactical moves. The slowness in the case of TIGO 0.00%↑ has several times lured less attentive investors into thinking “he is done, he is happy with what he owns”. While I, on the other hand, was wrong about speed — probably from reading the board wrongly — I have thus far been right about direction at every single turn. I was correct by looking at history and modus operandi.

Now consider this: the fees that Atlas (later merged into Iliad) paid to make the bid should be in the vicinity of $100 million, probably a bit above. This means that since the bid only netted just above 19 million shares, the cost per share was over $5. In effect they paid $31 per share. This is an extremely conservative estimate, both in terms of the size of the variable fees and because TIGO 0.00%↑ also hired their own advisors, whose costs Atlas bore 30% of indirectly.

With this in mind, does it seem likely that a 40% stake would be the end of this tale? They might as well have stayed under the mandatory threshold if that was all they were going to achieve for the cost.

My expectation is that in the near term we will se the ownership creep up towards 50%, through whatever combination of buybacks and market purchases is the cheapest and most capital efficient. And share repurchases are already ongoing at a decent clip. But the whole bid maneuver still won’t have been especially cost effective if a mere 50% ownership is the final destination. Mind you, once we get to 50%, Iliad faces some further complications.

Change of control

In any balance sheet heavy company, debt maturities and covenants is of utmost importance. TIGO 0.00%↑ has always managed their debt pretty well, even as operations has sputtered. The French have steered an aggressive deleveraging this year but debt is still a larger part than equity in the enterprise value. All the listed bonds have a change of control covenant, which states that if a shareholder crosses 50% and a rating agency lowers the credit rating within 90 days of that, then the bonds default. This means that the company would have to pay them all back at 101 cents on the dollar. Let’s just be a bit diplomatic and say that would fucking suck.

A Change of Control Triggering Event will occur if (i) among other things, any person gains direct or indirect control of more than 50 per cent. of the maximum number of votes (measured by voting power) that may be cast at a general meeting of the Issuer and (ii) within 90 days after the earlier of the announcement or the occurrence of a Change of Control of the Issuer, a rating agency withdraws its rating of the Issuer or downgrades its rating by (x) one or more gradations (if, on the Rating Date, the Issuer was not rated Investment Grade by at least two rating agencies) or (y) two or more gradations or such that the Issuer is no longer rated Investment Grade (if, on the Rating Date, the Issuer was rated Investment Grade by at least two rating agencies), provided that when announcing the relevant decision(s) to withdraw or decrease the rating, each such rating agency announces publicly or confirms in writing that such decision(s) resulted in whole or in part from the occurrence (or expected occurrence) of the Change of Control or the Issuer's announcement of the intention to effect a Change of Control.

As it happens, TIGO 0.00%↑ and Iliad both have ratings from Moody’s and Fitch. Moody’s rate them the same at Ba2. With Fitch there is a one notch difference in favor of TIGO 0.00%↑ per the update from December 4.

This wording leads me to believe that Fitch would consider aligning the ratings of TIGO 0.00%↑ and Iliad should Iliad increase their ownership interest substantially. As that would lead to a TIGO 0.00%↑ downgrade currently, this means that as of right now, Iliad would probably not risk going above 50%. However, considering their own financial trends, it is possible that Iliad gets an upgrade from Fitch in the not too distant future. If so, the aligning of ratings would not pose a downgrade risk.

The other way of nullifying the change of control clauses would be to negotiate them away for a fee. That is unlikely to be a good idea while only doing slow market purchases — too little bang for your buck. But it might be the way to go if Iliad decides to launch another bid some time in the future or opts to do a statutory merger of the companies. Remember that while some tax assets have been packaged away in the tower sale, there are a bunch of them left unused in TIGO 0.00%↑. Getting to use them efficiently is an important detail to laying this puzzle.

Squeeze-out?

Which takes us to the second question I posed, can Iliad force out the minority? The short answer to this question is no. Oh, you want the long answer? Too bad, you are going to get it.

Let’s assume that Iliad gets past the 50% hurdle in some way. The next threshold of major relevance is the squeeze-out level, which for a Luxembourg domiciled company such as TIGO 0.00%↑ is 95%. This high threshold works in favor of long-term minority shareholders; it makes it extremely hard to shake them out unless they want to sell.

Here’s a look at the most up-to-date shareholder list to confirm this.

Even if we assume that all the large Swedish institutions go away as a result of the de-listing from the Stockholm exchange, that still leaves us with four American shareholders with over 1%, who have all held shares for many years. Brandes has also recently been buying more shares. From today’s stock price, it should be impossible to do a take-under and complete de-listing of this company through regular means, unless we enter some major financial turmoil. And would it make sense as a strategy, considering they already completed a turnaround before launching the first bid this summer? While Iliad is certainly interested in increasing their ownership as much as possible, everything seems to indicate that they must be resigned to keeping around at least some minority shareholders for quite a while longer. Whatever they would prefer ideally.

I want to pause here for a second and highlight the buyback tender that Iliad performed in 2019. Note the details here: Xavier Niel was approached by willing sellers of shares, the program was constructed as an equal offer to all shareholders while saving the balance sheet of the company as they were in investment mode.

We now know that Iliad was fully bought out two years later, because they never got a valuation uplift in public markets. That, however, was not because of subterfuge from the owner — he heavily signaled to everybody who was interested in listening what he thought of the future. The market just thought otherwise. Telecom stocks generally were deeply unpopular — almost as unpopular as today if you can believe it — and Iliad earned little distinguishable acclaim at the time.

As it happens, we have a recent statement on what the largest shareholder thinks of future prospects in TIGO 0.00%↑. Thus far, the market has thought otherwise in this case too.

So a full cash buyout of TIGO 0.00%↑ seems extremely unlikely near-term and without intermediate steps. An alternative way forward, which gets more attractive the more Iliad owns, is to fully merge Iliad and TIGO 0.00%↑ and possibly collapse the holdco structure at Iliad.

In addition to the unlocking of tax assets, there is also another clear win-win possible in that a merger can — at least conceivably — be rating positive for both companies, creating an investment grade New York listed entity with transatlantic operations. A mirroring of AMX 0.00%↑ but with a better growth profile, satisfying both sets of bond- and shareholders. Backdoor re-listing Iliad could provide a fantastic platform for world telecom domination in the coming decades.

After all, that map in the office needs to be painted red.

Loyalty and reputation

Xavier Niel’s biographers highlight the loyalty he inspires among his employees and business partners, a recurring theme throughout his career and the story of Iliad. Employees, bankers, advisors, suppliers, and partners tend to remain. If they do their job well, they stay and receive opportunities for repeat business. This is the unusual business story which merges important elements of sustainable leadership with strategic opportunism.

While Xavier Niel's profile is well-established in his native France, both he and Iliad remain relatively unknown to the international public. However, the titans of Silicon Valley are well aware of this French business visionary. His recent AI initiative, Kyutai, has certainly boosted his recognition, though it’s just the latest in a long line of tech-related investments and innovations. Jeff Bezos, for one, appears to be quite impressed.

Much like Bezos had a bold vision for scaling retail by sacrificing margins, Niel and the Iliad team have their own unique ideas for transforming the telecom industry. And they’re far from done experimenting. Could customer service be the next area of revolution?

Similarly, just as Amazon was out of favor in the early 2000s, perhaps it’s not a universal law that telcos must always be undervalued and derided.

Perhaps long-lived infrastructure is holds significant value in a world where money is no longer free and new entrants are scarce or nonexistent? If that thesis is correct — and such assets are being effectively given away — it would make sense to acquire as much of them as possible, as quickly as possible. Furthermore, what if this customer relationship, in a converged and consolidated telecom world can be leveraged to create even greater value on an international scale by iterated cross-selling?

Conclusion

Nobody outside of the inner circle can say for sure what the next steps will be on this march to conquer the telecom world. Above, I have laid out a a couple of factors that I see as relevant for short-term structural moves in TIGO 0.00%↑. The biographical and business details are however no less important in assessing the complete picture. If you are an outstanding company builder, there must be a massive satisfaction in bringing with you people on that journey.

What exactly lays in the future is not knowable either. Weak currencies, political turmoil, natural disasters, increased competition. All these things — and probably more — can hurt the upside. But there’s very little doubt in my mind that the stock price would be significantly higher already, but not for events since May that have nothing at all to do with the underlying company fundamentals.

We may gain more clarity by mid-March, after the de-listing and once Iliad releases a new balance sheet. This should reflect their continued rapid organic deleveraging, the recent data center deal and the move of the TIGO 0.00%↑ and Tele2 shares into Iliad Holding. In the meantime, we are seeing aggressive share repurchases at clearly accretive prices. Last year, I mentioned $40 per share as a good minimum price to keep in mind. With all the major improvements since, I would now update this to at least $50.

From studying the past, I think chances are good that Iliad will be fair to the minority shareholders and a bit rough on share sellers. As always, a patient long-term orientation will be helpful in seeing this out.

Please remember to speak about telecom with your relatives over the holidays. Have a merry telco Christmas!

Luxembourg, January 14th, 2025 – Millicom International Cellular S.A. ("Millicom" or the “Company”), today announced that the Company’s Board of Directors (the “Board”) has approved a new shareholder remuneration policy under which it proposes to:

resume regular cash dividends;

sustain or grow cash dividends every year; and

maintain a prudent capital structure, with a long-term leverage target range of 2.0-2.5x

With this policy, the Board aims to return capital to shareholders from the cashflow generation of the Company in a consistent and prudent manner that reflects the capital-intensive and highly-regulated nature of the business, as well as the Latin American region’s elevated political and macroeconomic volatility.

Following the interim dividend of $1.00/share paid on January 10, the Board intends to approve an additional interim dividend, after Millicom publishes its Q4 2024 results, as follows:

$0.75/share to be paid in April 2025

Furthermore, the Board intends to propose for the approval of the Annual General Meeting of its shareholders to be held in Luxembourg on May 21, 2025, a dividend of $3.00 per share payable in four equal quarterly installments, as follows:

$0.75/share in July, 2025

$0.75/share in October, 2025

$0.75/share in January, 2026

$0.75/share in April, 2026

Thanks for the impressive write-up.

I have only started to appreciate recently how much time and effort must go into a comprehensive post, connecting multiple dots, like this one.