As a young investor, one of the very first stocks I bought was the Swedish ISP Bahnhof. It was the summer of 2009 and I started buying it at roughly 10 SEK per share. With the neat number of exactly 10 million shares outstanding, I was getting it at a valuation of 100 MSEK. That seemed very reasonable, since it was at about 10x net earnings and was growing 50% annually. Times were… different.

Anyway, the company now has a market cap north of 5 billion SEK. Of course — as I probably won’t even have to tell you — I wasn’t there for most of those gains. I obviously wasn’t smart enough to hold my shares for more than a couple of years. Unsurprisingly, though, this fired up a lasting interest in ISPs and telecom.

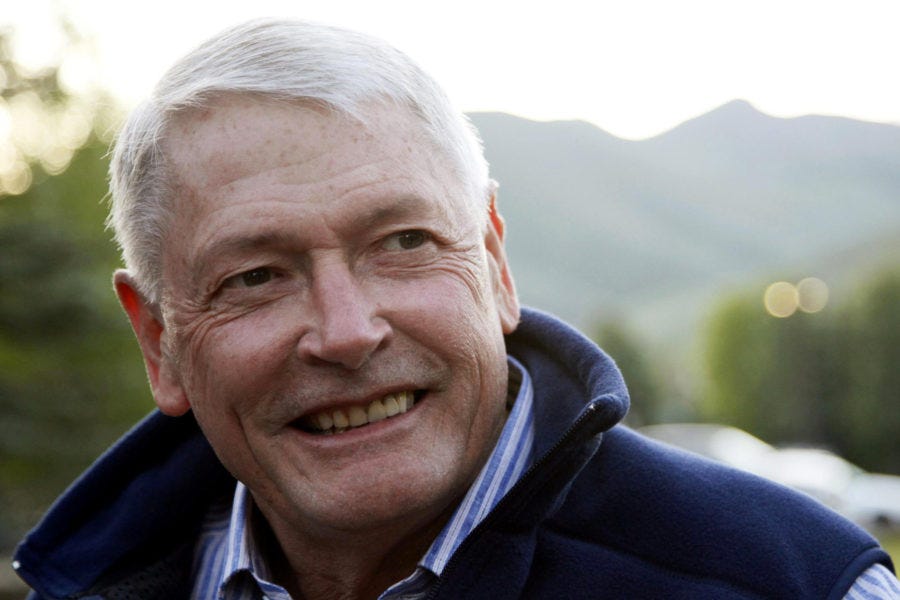

Soon after, I was introduced to John Malone and his Liberty sphere, and I devoured everything I could find about him, although at that point the internet material was scant and the bulk of learning came from a couple of forum threads and the book Cable Cowboy, which I have now probably read at least a handful of times. Up until discovering John Malone, I had little actual understanding of these businesses as such; what actually drove value in them.

As an interesting aside here, Jon Karlung, the cult figure CEO of Bahnhof is a pure operations and PR guy. He actively finds the finance stuff boring (I don’t think I’m butchering his words here), and Bahnhof has been run with sizable net cash and no debt pretty much ever since it turned profitable. Obviously, this is highly tax inefficient and something Malone would frown upon. Malone self-admittedly is not as much of an operations guy; he is instead financing side first. Both models can evidently be successful, depending on the circumstances.

From what I have learned of Xavier Niel (fun fact: both Niel and Karlung have a background in adult businesses) since his entry into TIGO 0.00%↑, he represents the syncretic option. He is both the best operator currently in the game and has played the capital markets and accounting side well too. That’s the reason why I am so enormously impressed by the Iliad team, and in spite of their generally good reputation, this aspect of it may still be underappreciated.

Anyway — after that obligatory French connection — not that long after I found out about John Malone, perhaps a year or so, the book The Outsiders was released, and Malone had his own chapter there. When that book hit big, I had the impression that a Malone cult formed in value investing circles. Maybe it was there before and I just wasn’t attuned to it. But in those mid-2010 years there was real hype around all things Liberty and there were even fund managers who almost exclusively focused on Liberty vehicles (apparently one went out of business for mishandling investor money… oops). Of course, peak excitement pretty much perfectly correlated with the maturation of most of the Malone controlled businesses. Just as people would have done the very best buying simple tech growth stories, they were the most interested in convoluted financial engineering. Of course, no nobody wants to even look at anything else than simple tech growth stories…

As mentioned, except for a few standouts such as Formula 1, returns have been terrible in the Malone universe for a long time now. They tend to be when you use debt, get multiple compression and growth stalls all at the same time. When even CHTR 0.00%↑, the “quality” name of love for all serious value investors across the pond, got hit with FWA competition and completely lost their halo, things soured to sentiment lows never seen before. I read the emblematic comment around this on X a little while back when someone called John Malone “a low interest rate phenomenon” and got broad support for this notion. Narrative always follows price.

Anyway, despite following Liberty for over a decade, I have only really bought one associated stock. I had a brief flirtation with LILAK 0.00%↑ and may be one of very few public market investors who have made money on the name. Mind you, I wouldn’t attribute any skill whatsoever to that particular outcome. Other than that, I have kept to watching from the sidelines.

Recently, something changed that notched up my level of interest to 12. Malone intimated that he has ordered his lieutenants to “put things in order” because he is not growing any younger. The subtext is that Malone, who is 83 years old, is doing some light estate planning well before the inevitable happens. This possibly removes an uncertainty which is otherwise always present in the Liberty complex: are you on the same side of the table as the insiders? If we are now suddenly unequivocally in the phase of surfacing values, whatever they actually are, then a giant hurdle has been cleared in making a case for investing alongside the good Doctor. Which takes us into the particular situation that I have my eyes most fixed on currently: SIRI 0.00%↑ and LSXMA 0.00%↑.

SIRI 0.00%↑ is a well-trodden case over the years, so I don’t think I have to make a complete presentation of the company from the ground up. Satellite radio in the US, 33 million subscribers, Howard Stern, huge for a lot of Americans who spend a bunch of time in-car. As I was writing this post a fresh pitch turned up which simplifies my job here.

I will proceed on the assumption that you are overall familiar with the company and the proposed transaction and focus on the details that I think contribute both to the mispricing and a significant potential for repricing. You can also read Andrew Walker’s post , which, while taking a negative angle, I think was a great read of the situation back in February.

So after that introduction, let me make the case down below in a more bulleted format.

BACKGROUND

LSXMA 0.00%↑ and LSXMK 0.00%↑ are tracking stocks which represent an 83% ownership of SIRI. The holdco and SIRI will merge to form new SIRI with a one class share structure. LSXM holders get 1 new share and SIRI 0.00%↑ after a 1 for 10 reverse split will get 0.83 new shares, that is 8.3 shares per current share. The new company consolidates debt from both sides. Transaction is slated for early Q3 consummation.

Here’s business projections from the Schedule 14A:

At a $2.70 share price this means that SIRI 0.00%↑ trades at a 2024E 11.5% FCF yield and and EV/EBITDA of 7.5. Levels that, with the cash-flow profile and under the assumption of easing of capex, only seem to make sense if there is a high near-term disruption risk.

LARGE SHAREHOLDERS

Berkshire Hathaway (likely a Ted Weschler position), John Malone (insider), Baupost (Seth Klarman)

BRK has been buying a lot at least until May 1. Seems to have stopped buying (could have shifted to under the radar purchases in SIRI 0.00%↑ as the discount closed, which will in that case show first in the Q2 13F, mid-August). Baupost has been decreasing

FIRST ANGLE: why is the price too low now?

When the companies merge it will suddenly be highly visible that SIRI 0.00%↑ is Berkshire’s 11th largest holding.

Stock might go up on this, as it will generate media. A fundamental buyer, Berkshire or anyone else, would want to buy maximum amount of stock before that. This could be an opportunity to get in as stock trades weakly after arb trade largely unwound by SIRI 0.00%↑ going down and closing down most of the the spread before the merger is yet to happen. Since there was a large spread for a very long time, but it has been hard to hedge it properly due to cost of borrow and squeeze risk, arbitrageurs might have chosen naked long LSXMA 0.00%↑ to express this trade. When the discount closed to almost nothing in the “wrong” direction, that trade was largely over, which might have temporarily contributed to selling. Some investors may have been more about playing the holdco discount and less keen on a potential absolute undervaluation of SIRI 0.00%↑.

Additionally, there has also been indiscriminate selling fronting an index exclusion on June 24.

"Barron’s wrote Wednesday that index-related selling could result in the sale of 75 to 100 million shares of Sirius XM, or 2% to 3% of its total shares outstanding, if it were to be dropped from the Nasdaq 100 index"

Note that this is 12-18% of the public float of SIRI 0.00%↑, which is positively enormous in terms of supply/demand disruption and must have had a huge impact in the last month of trading.

Essentially, value investors, Malone cultists and holdco discount enjoyers (make a Venn diagram) have burned themselves on this name for years and years and years and then when there finally is a deal on the table they get third degree burns, but this time possibly for reasons unrelated to business quality or overestimation of catalysts. Ironic.

SECOND ANGLE: why is this transaction being done now?

While Berkshire might currently be buying in SIRI 0.00%↑ in order to avoid reporting individual purchases, there would, in comparison to BRK's funds, be little financial room to do so due to the limited trading. Also, the extremely weak stock price could indicate that BRK is completely gone as a buyer. Lack of stock repurchases before the merger might also be partial explanation, but they have not been big for the last few Qs anyway. Malone doesn't often make over the market purchases, but sometimes he buys stocks at lows, such as LILAK 0.00%↑ recently. He has not yet bought any LSXMA 0.00%↑, possibly it hasn’t been possible for a while due to insider status.

John Malone is doing some slow estate planning lately and putting his house in order. Has told his lieutenants to surface values and simplify. Theoretically, all his holdings are for sale, at least as long as the sale doesn't trigger massive taxes. Can new SIRI in its entirety be sold tax efficiently?

Fancy-schmanzy proposal: Berkshire and John Malone could do a stock swap? AAPL 0.00%↑ for SIRI 0.00%↑. Berkshire can sell some more AAPL 0.00%↑ without paying taxes and John Malone gets extremely liquid shares, can put a collar on the stock he receives so there is low/no risk of loss and then the cost basis is reset for his heirs when the day comes. Win-win-win.

Last month's pattern of extremely weak stock price, no known buys from Berkshire and no insider purchases would fit with ongoing takeover talks. Although a bit of a long-shot, takeover news probably wouldn't drop until the merger is done, but might happen before Q3 13F shows how large of an owner Berkshire is in "new SIRI".

TRADE

Buy LSXMA/LSXMK/SIRI and hold past merger until Q3 13F, Nov 15th, or until or until re-rating back to mature low to no real growth business with great cash flow capabilities. Note that this is not an arbitrage trade unless you play in both legs, this is a long that you can express in the cheapest way which is via the holdco tracking stocks, currently about 5% cheaper than SIRI 0.00%↑.

RISKS

The always present worry with SIRI 0.00%↑ is of obsolescence. I don't have an answer on this risk that's better than anyone else’s. Spotify and other streaming services have been around for quite a while with no dramatic deterioration as an effect.

I don't see how this risk has changed materially in the last couple of years. SIRI 0.00%↑ has gone from growth stock to mature business to a possibly disrupted valuation without that much visible underlying change. I think the asset might very well have some strategic value (that is beyond what a financial buyer would be willing to pay) and that the large holders are interested in monetizing that value in short order.

Getting in the same boat as Malone (as a skilled seller) and Weschler (as a skilled buyer of securities) is worth some consideration, although it shouldn’t be used as a security blanket. While you would have made money getting into DirecTV back in the day, that was essentially only because Malone made a skillful exit, as the asset’s value imploded shortly afterwards.

I do however think there is merit to the view that SIRI 0.00%↑ has a large ballast of subscribers who are on the other side of middle age that won’t suddenly start churning fast. For a millennial such as me or the actually young people out there the value proposition of the product is a bit of a mystery. And yet it moves. Many years after everybody already saw that on-demand internet streaming was the future.

Other bad news: Howard Stern hinting of leaving as his contract ends next year, ad revenue down and large negative net adds in Q1. Auto sales have been slow which might be a cyclical factor behind higher net churn. Botched new app launch may also have contributed, but is hopefully being rectified. In spite of some weak points, FY guidance was kept in Q1 and the CEO emphasized being very comfortable with the targets in May. Note that the share price fall doesn’t seem to be associated in time with release of new financial figures. Stock price is down 50% this year and while this is a company with a lot of debt on, and will take on more with the merger, it doesn’t seem like the business prospects has changed to anywhere near the degree that the share price move would indicate.

FINAL NOTE

In the last week or so, there has been some “meme activity” in SIRI 0.00%↑on the basis of the large short interest in the stock. This buying may have mitigated some of the late downward pressure from index selling, but I don’t think the squeeze potential is that huge when there is a pretty definite timeline on the transaction, arbitrageurs will have good incentives to commit more capital to the trade and if the spread between SIRI 0.00%↑ and LSXMA 0.00%↑ widens, more arbitrageurs should be attracted in response. Essentially all the meme buying seems to have done was temporarily widen the spread from ~5% to ~10% and now it’s back down again, while LSXMA 0.00%↑ was essentially unmoved by the shenanigans. The dynamics are not exploitable as it was when the holdco structure was of an indefinite nature.

Disclaimer: I am unlikely to provide real time updates on this case as it develops, do your own due diligence.

I accidentally deleted some legit comment when I was removing spam, sorry for that! Not on purpose.

Does Berkshires recent sell of Apple shares play into this in any way?