Alright, so my general policy is not to speak publicly about illiquid names that I hold. But, you know, if you don’t like my principles — I have others. This situation has been repeatedly written up this year by the American Alluvial Fund, so I’m not actually covering new ground here anyway. Note — I do NOT recommend anyone to buy anything. If you get into this stock there is a real risk that you will be stuck and never get your money out. It really is illiquid. Ok, so I guess that’s enough of a rationalization and preamble.

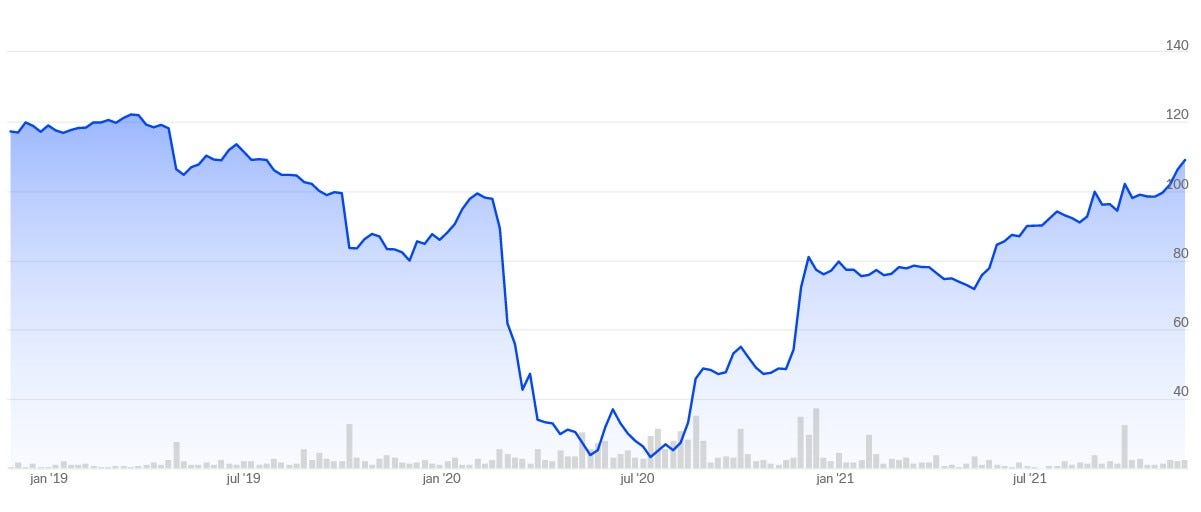

The stock in question is Pegroco Pref. It was listed back in 2015 in the big Swedish preferred craze. Like many non-real estate related preferred issues, it has not been a great success. Attached to it is a 9.50 SEK dividend, divided up into quarterly instalments. Like all Swedish preferreds it is non-participating. The dividend is what you get (hopefully) and general interest rates essentially set the floor and ceiling of the price. As long as the company stays current, obviously.

Pegroco is an investment company with a kind of ragtag assortment of holdings, most of which have not produced much cashflows. In 2019, the company went into crisis after an unpredicted bankruptcy at a daughter company. Consequently, it had to borrow from its shareholders and also get emergency financing from a bank consortium. The dividend on the preferred was cut in half early 2020. Then Covid struck and most other companies in the group also went into crisis… Before even the first distribution of the lowered dividend was paid out it was instead eliminated altogether.

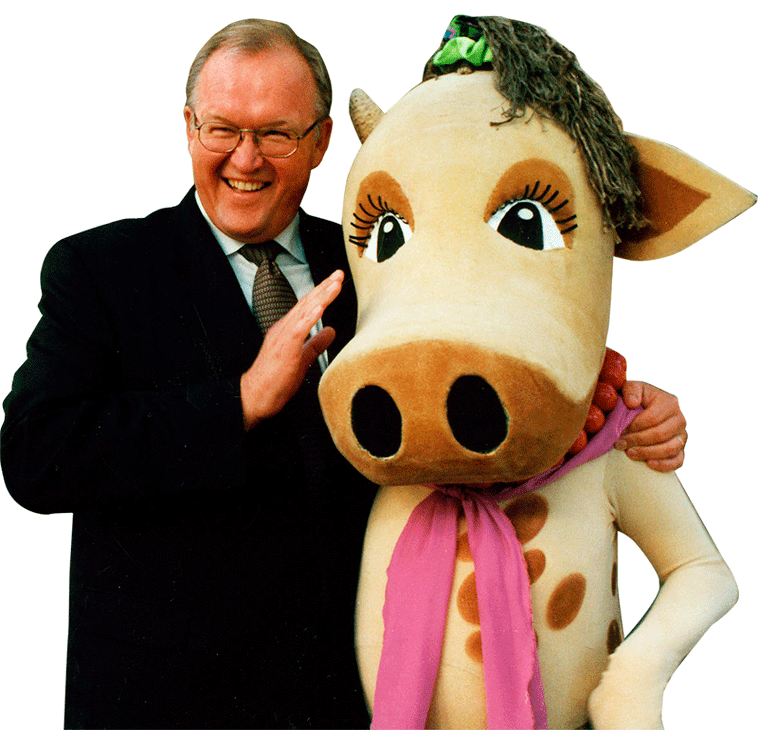

As a fun side note, legendary Swedish Prime Minister Göran Persson (1996-2006) was chairman of the company up until the crisis started in 2019. After being nominated to the prestigious chairmanship at Swedbank, he was probably pretty grateful for the opportunity to quietly duck out of the Pegroco mess.

Luckily for Pegroco, the swift paydown plan on the emergency loan was extended due to Covid. And the company has kept to that plan to this day. Although it’s surely been a wild ride for the preferred shareholders.

The emerging story out of Pegroco is that of Nordisk Bergteknik (NORB), which is now the by far largest holding. It’s a roll-up of companies active in drilling and blasting in the Nordic markets. The company had a lukewarm IPO in October, somewhat to my surprise. It was kind of squished in between some other highly anticipated listings and didn’t really catch the eye of the market. However, after an apprehensive start, the share price has since kicked on. In these markets I think there is a lot more potential for investors to really like this fast-growing serial acquirer. Although, I’d like to stress that I’m personally fairly agnostic on the stock as such. Not really my personal wheelhouse.

Pegroco held on to almost all of its stake in Nordisk Bergteknik in the IPO. They sold only 1 million shares at 26 SEK and are still the by far largest shareholder at just shy of 30%. Those remaining shares are in a 1 year lock-up. At current market prices, this stake is worth about 500 million SEK. The impression is that Pegroco sees a lot more rolling up to do in the near future and are unreservedly bullish on NORB still.

There has been pretty consistent insider purchasing in the unlisted common share of Pegroco for the last year or so, which has coincided with good growth in its NAV. In the preferred, there were some buys last fall and have been some sales lately. All of those recent sales — thus far — however did precede the NORB IPO, so you might suspect that insiders needed some funds in order to subscribe to or buy shares.

I would be remiss here if I didnt mention what some basic googling turns up about key people at Pegroco. The chairman of the board was sentenced for insider trading which he committed as CEO of Bure in 2002. Another Pegroco board member is currently suspected of revealing insider information in Mantex, where he is chairman of the board (on leave pending investigation).

I don’t know these people personally and they aren’t really famous so I can’t speak much to their characters. But — without being unfair — Pegroco has historically been active in parts of the stock market where there is a bit of a Wild West mentality overall. I don’t think these issues disqualify the preferred stock as an investment, though. Insiders own a lot of common shares and some preferred. If they want an ultimate return on that investment, the preferred will have to be paid first.

Now, as usual for me I have probably been a bit too bullish on the timeline. When I saw the very specific number of old shares on sale in the IPO, I thought, well, that seems like a convenient sum. It was very similar to the amount of bank debt left at the parent level, which needed to be paid off before being able to restart dividends. After all, why — specifically — were they disposing any shares at all if they settled on selling so damn few?

My anticipation was for the Q3 report to reveal that the debt was fully paid off after the NORB IPO, but what actually was communicated was slightly different. The remaining debt amount has now been renegotiated at lower interest levels and put up with a single bank. The overarching goal is still a debt-free parent but this seems not as totally imminent as I first imagined.

If we parse some language from the Q3 presentation slides, it says at the bottom: “In the short term, indebtedness is something that partly limits dividend capacity in the preferred share”. Partly. Hmm.

Additionally, on the call (in Swedish) this was said:

“We get a lot of questions on the preferred dividend and on that we have a decision from the shareholders’ meeting (no dividend, my remark) and an upcoming decision on the shareholders’ meeting which decides whether we should do a distribution or not. But the overall goal has been to move from an indebted parent to a debt-free parent. But as I said, it’s up to the shareholders’ meeting to decide.”

Now, I’m not 100% positive if this means we will have to wait until the AGM in the spring or if an EGM might be convened before that. Pegroco had no less than 2 EGM’s in 2021, so I wouldn’t put it past them to convene one early in order to get rid of the 10% interest with no tax benefit that the dividends in arrears cost. But perhaps they are looking to get some distribution from NORB before they feel comfortable with paying off all the dividends in arrears on the preferred?

The cash position of 63 million SEK has stayed roughly the same between the quarters lately and they probably need to keep some additional on hand to work through the situation at Infraservice, where the government agency Trafikverket is withholding payments due to a dispute about services rendered. But the 26 million in cash from the NORB stock sale seems likely to be earmarked towards paying down the 21 million of debt to shareholders and/or the bank debt of 29 million.

If we work from the assumption that Pegroco is debt-free at the latest around the regular time of the AGM in the spring, we can look at our return potential here. Last year the AGM was held on May 6 — let’s just say 6 months away for maximum ease of math.

Dividend in arrears total 31.7 million per end of Q3 (19.81 SEK per share). There is one more payment due this year, which would take this up to 35.5 million. Adding 10%*0.5 years of interest on that and yet another distribution end of March takes us to a total of 41 million or 25.63 SEK per share.

The next question is, where should the share trade when it is finally current? Well, a lot of the solid preferreds in Sweden trade at about a 6% yield. Some RE developers are higher than that at above 7%. Pegroco is redeemable for the company at 115, which is an 8.17% yield. 115 doesn’t strike me as at all outlandish for this security once it is current. They are very unlikely to redeem the preferred any time soon even should it trade over that level. This would still be a way higher yield than any — admittedly flawed — comps. However, as of now Pegroco doesn’t inherently have more business risk than an RE developer, and additionally the preferred series is only 1.6 million shares. Granted, these yields will have to be higher, and preferred share prices lower, if general interest rates go up in the interim. But with the relatively high yield assumed on Pegroco Pref, I think we have some leeway to work with even under such circumstances.

Anyway, given these assumptions, Pegroco Pref is worth 140.63 SEK in 6 months against last closing price as of this writing at 108.50. This implies a 29.6% return, or 68% annualized. I think this timeline is a good ballpark outer limit, and I would put the reasonable expected value somewhat lower than 6 months, perhaps taking the expected CAGR up towards 100%.

As always, a lot of guesses go into this — you obviously have to make your own mind up if this makes sense in all the relevant ways: company fundamentals, timeline, basic logic. I don’t think I’m being overly aggressive, but naturally I can’t guarantee that I’m right and shit can always happen. Most of the adverse scenarios I can conjure up, though, do seem to involve just a muddling through. In those cases there won’t necessarily be a stellar performance, but we will always live to see yet another day.

Much like a Social Democratic Prime Minister.

As of late, Sweden has been hurtling from one political crisis to another. Our new coalition government — installed this very week — lasted all of 7 hours. As we enter an election year in 2022, more and more people are waxing poetic about the good old days when the supreme leader, Göran Persson, ruled the land with a steady hand.

Me myself, however, I don’t like to look that far back in history. I just want to Make Pegroco Pref A Great Cash Cow Again.