I spend some time thinking about what role capital flows play in market pricing. For the macro picture, it’s probably a distraction. I can’t predict when fear will take over from greed or vice versa. But if there is decent enough liquidity in a specific stock, then thinking about why a stock trades like it does seems infinitely more valuable than the usual game of finding ever more inventive ways to convince yourself that it has an unassailable Moat (tm).

Obviously there is a lot of randomness and noise in this area — I’m not much interested in the latest price target from JP Morgan or even what’s tumbling around in the rumour mill. These things matter to pricing short-term, but I can’t reliably get in front of them, so there’s no use in expending energy on it.

What I’m primarily looking for are mechanical, technical and event-driven reasons for disruptions in the market’s price discovery. Mandatory bids and mergers paid for with a — preferably large — stock component have been especially ripe hunting grounds in the last few years. Ever since a situation a couple of years ago in a company called Rezidor (later Radisson), I have taken a keen interest in these.

Why are they so interesting?

Well, first of all you immediately have evidence that someone wants to buy the thing. So the likelihood that the asset is not complete shit increases. Of course, all of a certain segment might be hot air and then this obviously doesn’t help very much. But it’s a nice start.

Both mergers and mandatories tend to create what I will succinctly name the Bid-Induced Comatose State (BICS). The cool kids might have another name for this that I don’t know about, because I can hardly be alone in repeatedly observing this effect.

How does this coma happen? In the case of a mandatory bid, this is a pretty rare liquidity event. A large holder gets a certain optionality that is otherwise not as easily afforded him. So he might choose to sell even if the bid is not very generous, because he would like to buy Tesla or some other stock that will go up much more. If the market price is above the mandatory level, he will obviously opt to sell over the market, which will tend to push down the price towards the bid level.

A smaller shareholder can be more nimble and will in a lot of cases realize that this mandatory bid will likely put a damper on the rocket emoji potential of this already boring-ass stock. Thus, he will sell, put his money in TSLA and look to come back in at a way later date next month or so. This will also help push down the stock.

That’s pretty much it for a mandatory bid. There is an interested buyer that can create a bunch of sellers, but this situation will dissipate in due course. Something to watch out for is of course that the mandatory might reach a squeeze-out or near enough that the majority holder gets a lockhold on the share. This results in a dead money situation for the minority, and sometimes even a complete decoupling between price and fundamental value. All the little nuances of this risk are too numerous to list, but it is — while unlikely to lead to large losses — far from ideal. As always, you can’t analyze only by pattern recognition to historic parallels; each situation is unique.

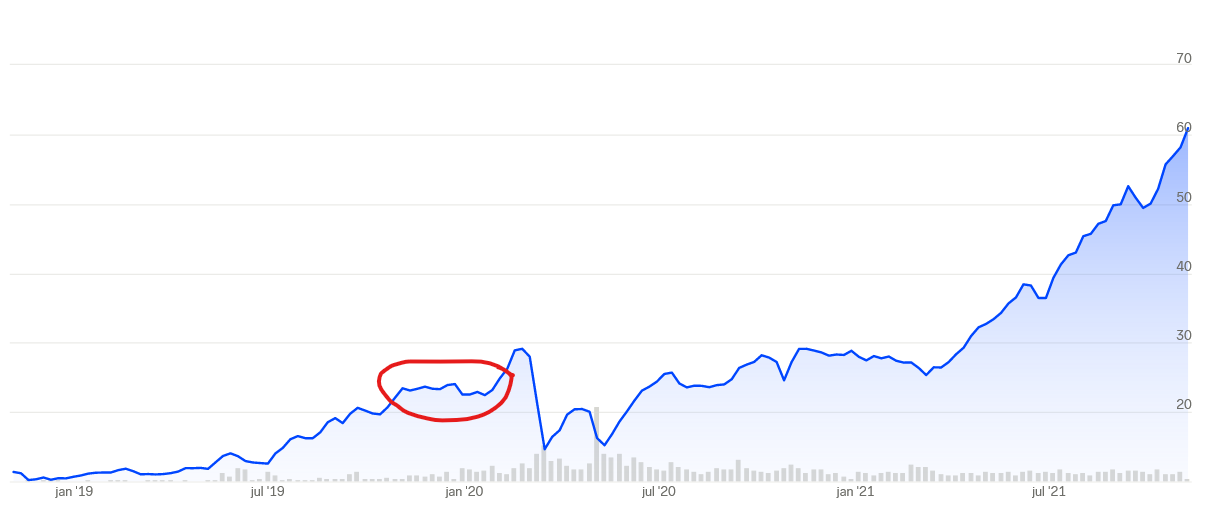

Before I get into some specifics around a stock-based merger BICS situation, I will do a graph dump. These are very poorly disguised situations in the Swedish market from the last few years. I have marked the approximate BICS period with a red circle. They are all three-year graphs except one stock, because it hasn’t been listed for that long. Obviously, the most interesting part is the performance in the next weeks or months after the circle. Finding the companies is left as a fun exercise for the reader.

On the day of announcement of a stock-for-stock merger, there is a wild scramble to get borrow in the acquirer in order to hedge the merger arbitrage and lock in a profit. This establishes a price feedback loop between the acquirer and the acquiree. Additionally, shareholders of the acquiree, often having participated in a nice merger price bump, are prompted to sell and go buy Tesla. After all, there won’t be much news here until this dreary merger has resolved itself and who cares about a possible few percent of return in risk arbitrage anyway? And then after that there will be a period of cost-taking and integration. Boooring.

A mandatory bid usually caps the situation both to the downside (because there is a buyer) and the upside (the buyer is usually too dominant to allow for a bidding war). The most interesting kind of merger BICS situations involve immediately value-creating deals, where the deal results in significant additional operational scale or financing efficiencies. Of course, the larger the deal the better the potential upside.

If the rest of the sector performs well under the BICS period there is a potential double-whammy to be had. If there is decent percent return arbitrage additionally, you are up to a triple. Obviously it works less well if the peer stocks go down in the interim - but with a cool head, a nimble mindset and less than billions, it is possible to step aside that oncoming train.

Since I have written about this stock before, I will end with the rare bird, the double BICS.

I didn’t get the future order of events right with this one in my original write-up. But it first had a mandatory bid, then swallowed Klövern, a company much larger than itself. Then Rutger Arnhult, the man behind the mandatory, bought even more stock along with his brother over the market. Finally, the market ultimately seems to have completely come around to my original thesis, namely that the company will be acquired by Castellum. Currently, it may even have overshot a bit in discounting that possibility. But I wouldn’t dare to make definitive pronouncements on that.

There are always about a handful of these developing or ongoing. Many are slow like paint drying and won’t go much of anywhere. You can’t just buy them in bulk and expect to outperform. So I’m not that afraid of giving away edge by revealing this “big secret”. There was no magic way to riches in this post either. Sorry.

Nevertheless, do I see any interesting situations on this general theme right now? Yes, as a matter of fact, I do have at least one on my mind. If the situation stays intact, I might write about it soon.