Note: This post was written before Iliad bought Kinnevik’s stake in Tele2.

I did not intend to write anything more about Tigo at least until something new happened. But here we go anyway, buckle up.

As has already been announced by the company, Q4 will contain a lot of one-offs, such as severance pay. Naturally, I don’t have more insight than anyone else on those parts, beyond what is already public. Likewise for other possible impacts, such as the costs incurred from a recent ransomware attack in Paraguay (early in Q1, though) or legal costs in Guatemala or otherwise. I do however think we can get some clues on the operational side from recent reports by other companies. So with a large risk of looking like a mug, I will attempt that.

All of Tigo’s peers have released their Q4s at this point. You can read across to some extent, of course keeping in mind that all companies’ performances have idiosyncratic strengths and weaknesses. The most important markets for Tigo are Guatemala and Colombia. Carlos Slim’s America Movil (AMX) does not separate out their Guatemala division, but it does represent the largest single part of their Central America segment.

As can be seen in the last few quarters, the margin has strengthened. This is in line with comments from both Tigo and AMX in recent quarters on Guatemala specifically and bodes well on the return to market equilibrium, which is the most single most important operational KPI for Tigo in the short to medium term. A minus is that AMX has talked about good traction in B2B for the last two quarters (this time they didn’t single out Guatemala but they did so in Q3) and that is somewhat zero sum. However, it shouldn’t stop Tigo from reporting an overall continued improvement in their EBITDA margin.

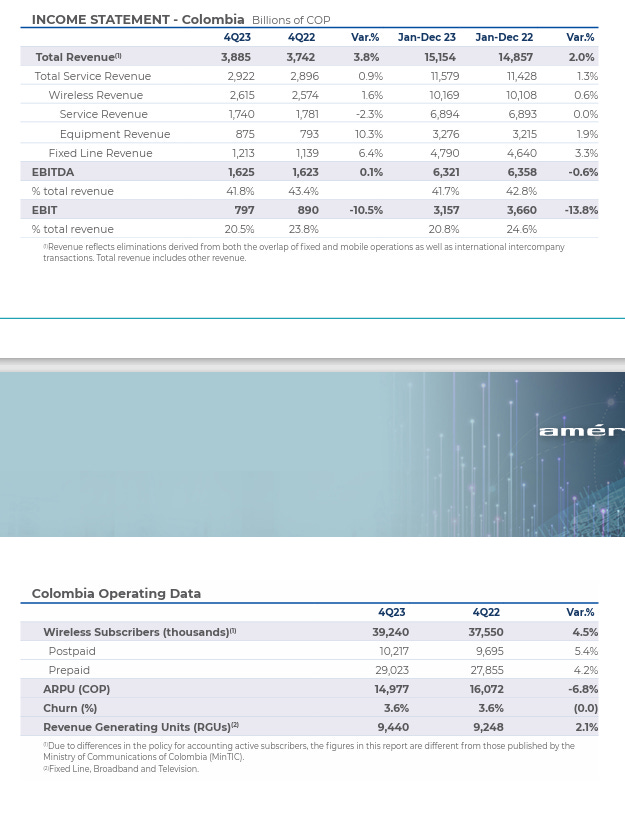

Next up Colombia.

Telefonica seems to be managing Movistar Colombia for cash flow. This is in line with recent trends, where Telefonica has bled customers to primarily WOM and Tigo while AMX has been rather stable. As can be seen in the table, Telefonica does seem to accept a high level of churn without discounting their frontbook much to make up for it, instead opting to keep focus on raising prices in their backbook. This can be gleaned from the raised EBITDA margin combined with a steep falloff in handset sales. Customer and churn numbers are not reported, but they wouldn’t be flattering.

AMX on the other hand has stepped up their customer intake in Colombia in Q4, while also saying that the price competition has abated somewhat in the second half of 2023. This is, apart from Telefonica’s numbers, confirmed by their ARPU being up somewhat in the last two quarters in spite of a high customer intake. Naturally, a high customer intake pressures margins somewhat.

For WOM I don’t know if there are any public figures, but their boss stepped back into the Chile operations and it looks like they are having issues continuing to fund aggressive customer acquisition, not least because lending is so tight in Colombia. The pattern may suggest that WOM is looking for a way out of the country.

In structural terms, Claro (AMX) has been declared “a dominant player” in the Colombian market for about 2 years. In practice, I don’t know if this has lead to any regulatory changes up until this point, but AMX expressed some worry about this in the Q4 conference call and the other actors have been lobbying heavily to make the sector less lopsided profit-wise. Like in many European countries, if the government wants that large 5g investment, there will need to be more consolidation beyond the infra JV between Tigo and Telefonica, which was a good first step to take down spectrum costs.

Marcelo Cataldo, the CEO of Tigo UNE, has stated that the company has 15 million customers by year end, which indicates continued great customer growth. All in all, Colombia should exhibit good growth and roughly stable EBITDA margins for Q4, which I think will comfortably meet expectations.

As for the smaller countries, LILA showed okay numbers in Panama, which should be a sign in the right direction for Tigo too. Some pressure on postpaid recently, presumably due to some recent political turmoil and issues around the Panama canal. With a relatively high GDP/capita and the consolidation, Panama does hold some not insignificant structural promise, in spite of recent issues.

Beyond that I don’t have much to go on in other countries, and it doesn’t make sense to overly focus in on them at an individual level due to them each representing such a small part of the portfolio. As a group, I think one can assume that they will even out to a decent level in the quarter and if not, hopefully they will over time. Some variability is to be expected and countries will experience disruptions periodically.

Carlos Slim recently called Telmex/Telcel (America Movil’s Mexican operations) a bad business and intimated that he has kept it mainly for sentimental reasons. While I think he is employing some hyperbole there, which is meant for domestic media consumption, the basic point is true. Telecom is a mediocre business. But a lot of the capex taken does give rise to rather good real estate businesses, namely fiber infrastructure, data centers and mobile towers. It’s just that this drowns in the sluggish growth of the main business and is most often eventually sold off or spun out, always leaving a company with a worse revenue mix. And in the case of public or bureucrat controlled telcos, the money is squandered on god knows what.

Anyway, Carlos Slim has recently spun out towers from two of his companies. Sitios Latinoamerica was spun out of AMX in 2022 and has been growing their portfolio since. This fall, Telekom Austria, which is a listed company but majority owned by AMX, also spun out and listed their towers as Euro Telesites (ETS.VI). Their portfolio is about half Austria and half Balkan countries.

AMX is famous for their strong balance sheet combined with superior operations. They certainly didn’t need to sell off their infra assets to pay down debt. But the alternative was there, and they would have received a much better price tag than what the stocks are now trading for publicly.

One thing about the structure of Sitios is rather curious. About half of their contracts are in USD, of course signed with AMX since the towers were originally theirs. Only Guatemala (the quetzal is tightly linked to USD anyway due to remittances), Brazil (which has the most valuable towers in Latin America) and Peru (the majority of those towers were sold into Sitios after listing) are contracted in local currencies. Why is that? The rather weak Central and South American currencies should be expected to have structurally higher inflation than the US in the future too. What this means is that AMX essentially gives up a degree of certainty in cash flows to transfer more earnings into Sitios. AMX is giving Sitios a put option on local currencies for free. If AMX was highly levered, this structure would be dangerous for the mother company. But what this does is increase earnings where they can get a higher multiple and are a lot more leveragable. And since the contracts are in USD, that means that the flows are more predictable and that you can also borrow at much cheaper rates in USD against the towers. Smart, isn’t it?

On the other hand, Slim has not at all maximized the traded multiple for Sitios. For one thing, no dividends are paid (in ETS.VI they even promised no dividends for 5 years). Additionally, AMX has a lot of American shareholders but Sitios was only listed in Mexico. Listing a spin-off on a smaller exchange (and not one with a good reputation either) is classic move of value suppression. You would expect a lot of AMX shareholders to not even be able to hold onto their Sitios shares. Perhaps not surprisingly, it seems like Slim has increased his holdings in Sitios since the spin up to 52%, compared to a 45% stake in AMX.

With all this in mind, I would expect the Slim empire to want to grow their tower companies and be willing to continue increasing their relative exposure to it at below-market multiples. One way to do that is of course by buying orphaned shares over the exchange, and another, more concentrated, may be via equity raises that would interest the controlling shareholder a lot more than others. Perhaps as a way to finance large portfolio purchases?

Now, is any of this really relevant to Tigo? To be quite frank, I don’t know — it may be. When Tigo delayed their reporting date, I assumed that it was to align with when Iliad usually reports, which is towards the end of the reporting period. Not necessarily for any reasons to do with special corporate events, just because corporate groups with several listed vehicles tend to cluster their reporting dates closely together. Iliad has since pushed out their Q4 two weeks later than usual into mid-March, which may have something to do with the truly tragic sudden death of their CFO (and Tigo board member), Nicolas Jaeger, at only 45 years old.

So, anyway, just like I’m curios about Telefonica, LILA and AMX, I am of course curious about Sitios and their Q4…. but Sitios has not yet reported. Ever since listing they have always released mid-period, just like AMX, slightly before Tigo, like clockwork. This time AMX reported on Feb 13; Telekom Austria reported on Feb 13; ETS.VI reported on Feb 13. I spot a pattern for Grupo Carso.

But Sitios has, like Tigo, delayed their report (note for Swedes: just like AMX, and many US companies, Sitios doesn’t pre-announce all their earnings dates for the full year in one swoop, they give notice just a short while in advance for each individual quarter). In fact they will release their report on Feb 26, after close, just as is customary on the other side of the pond and hold their conference call on the morning after. So, combined with Tigo’s Q4 which is both released and presented on Feb 27 before open in the US, we will hopefully get a lot more knowledge about the state of Latin American telecom towers in those reports, which are coincidentally released concurrently for the first time ever.

Privately, I was already months ago a bit suspicious that the end of Xavier Niel’s purchases and the delayed reporting date was a convenient way to give more time to “undisturb” the share price. However, when the buyback program was initiated I dismissed those thoughts and started thinking more about them going a piecemeal route to increasing Niel’s ownership in Tigo (as you can read about in my last post). Turns out they got me good, because there was a timed kill switch in the automatic buyback program that was set already back in December. For the last two weeks, repurchases have suddenly been minimal in spite of a falling price, which puts back on the table the consideration that they do care a lot where the stock trades or at least about not keeping the price up unnecessarily.

I don’t think they could have foreseen this much success back in December in letting the stock trade down; the general telco sentiment and rates related selldown has certainly helped. The program had a limit of 210 SEK average price paid, which should probably tell you something about their sensitivity to price back in December after the improved guidance. Overall, Niel’s prior purchases struck me as not as bothered about absolute price levels as avoiding to add to upwards momentum. There is not much of a pattern to spot around absolute price levels in terms of volume traded, but the broker tended to buy a lot less on up days. Anyhow, I have a hard time coming up with reasons for the specific timed structure of the buybacks other than them being at least passively part of an overall M&A strategy. What that exactly means in the short term, I don’t know.

What I do know is that I have to a great extent failed in my main mission of the last year. These posts have been largely aimed at trying to convince institutions to have some patience and not sell out too cheaply. I know that a decent amount of fund managers have read my posts, because I have spoken to a few of them. But I also of course understand that they have 1000 other considerations which have nothing to do with the perceived value of Tigo. Swedbank Robur looks to now be on their way out completely. For what reason, I don’t know, but they may be making a better judgment than me, obviously.

The American funds seem more stubborn, with Dodge staying above the 5% filing threshold thus far. Hopefully the American shareholders are aware of just how strong the minority protection is in Swedish listed entities. It’s just not possible to do the things majority owners sometimes do in the US here, and I sincerely hope that everybody is adequately informed about the strength of the hand that they are actually playing. So long as there is a 10% minority, there are great checks against what a majority shareholder can do. That is important to keep in mind for all possible future scenarios.

“But it’s a controlled company, bro”

Apart from the minor issue of almost universally negative opinions on the sector, the operations, the management and the geography, this is by far the most common response that I have had. Essentially it can be summarized as such: now that someone has the majority vote, you are completely in their hands. They can choose to recap the company or take it out at the most inopportune moment and essentially suck away all the possible value there is for outside shareholders. Credit where it’s due, I think this is a better lens to ponder a situation through than to essentially just stop your thinking the minute some guru is holding the same stock as you. That said, I do believe this risk is overstated.

As for the risk of another rights offering, I would make two arguments against that. Firstly, Xavier Niel has as far as I am aware no history whatsoever of forcing down rights offerings in his companies. His modus operandi is generally rather the opposite. He does JVs to get leverage off balance sheet, he terms out debts as far as possible and he strips out assets and uses the money for dividends or buybacks if the stock is cheap.

For a look at something outside telecom, in mall-owner giant Unibail-Rodamco-Westfield (URW.PA), he quickly moved up to largest owner in order to stop a rights offering proposed by management at the height of covid in the fall of 2020. The reason? He thought maturities were far enough off that it was smarter to wait it out and see if operations turned around first, while trying to divest US assets. He won the vote and the results have been that URW.PA has improved in pretty much all respects since, has not needed to make as many divestments as initially assumed and have seen no credit rating pressure since the rate hiking cycle began. Things have in fact gone so well that they recently reinstituted a dividend. The contrast to where many other European real estate operators are currently couldn’t possibly be more stark.

Secondly, Xavier Niel is busy both doing and looking for other deals. I wrote about what he has already done in my last post. He has said that he is actively looking for telecom assets. All of Patrick Drahi’s holdings are on the block. Liberty Global with their recent announcement have essentially also put out the for sale sign, although they may not completely desperate to sell rather than go through with the spin-offs. There’s a myriad of other sellers and financially distressed operations all over the world. And I’m yet far from convinced that the last word has been said about an Iliad and Vodafone Italia tie-up.

With all these possible uses for capital, making the Tigo bet more capital intensive in order to screw retail out of comparatively piddling money would be literally insane. Niel has more ideas than money. Granted, his abundance of possibilities also works against the chances of a takeover, but I think that can be solved for with the correct structure, if the will is there. And also, I don’t even believe shareholders in Tigo should hope for a takeover at this point in time.

As for the risk of an opportunistic takeover type of scenario: if that is the largest risk present then we don’t have much of an issue. Niel has historically chosen his moments well with takeovers. And, depending on other opportunities, we may be in such a moment, with some of Tigo’s markets showing improvements and as all the recent cost-cutting has not yet trickled into operational results. Hence my appeal, once again, to fellow shareholders to think twice about what they do going forward. But, mind you, that is not a bear case, it’s a question of how the bull case can be unpleasantly capped.

Overall, strategically, it pains me to admit that up to this point this has been played like a great French symphony, and I would fully expect that to continue. While I understand and appreciate that this is the way of stock market capitalism, I also think, after doing a lot of background reading that Xavier Niel’s team is hardworking, skilled, entrepreneurial and honest. I think I have reason to assume that they will treat all stakeholders fairly, even though I wouldn’t expect them to leave money on the table out of altruism either. After all, they have over time earned an immaculate reputation in the capital markets.

On the Q4:

It was even better than I had dared to hope. Guatemala was a surprise to the upside on margin and they have taken more price increases in Q1 AND made more cost cutting that is not fully visible yet. Panama was amazingly strong with the B2B customer intake. Colombia was extra strong on margin while customer intake took a bit of a breather. Overall, the read-acrosses I had from competitors were quite instructive and the amazing cost cutting program is doing wonders in addition to that.

Forward guidance on operations was extremely bullish. However, if you account for one-offs and such it looks like they may still be too conservative with the updated guidance

No Lati announcement yet as I had hoped and thought, but I think there is no reason to worry about that.

All in all, both the results improving so quickly and the communication indicates that Atlas intends full alignment with the outside shareholders. This also make sense when considering the Tele2 purchase; antagonizing minority investors in Sweden (and elsewhere) seems like it would be a bad business decision when you are suddenly controlling two Swedish listed entities. Note that Iliad's CEO has already said that they are not looking to take out Tele2 and they structured the purchase of shares as to avoid tripping the mandatory bid threshold, while maximizing the economic interest.

The relatively large bond repurchases with long maturities and low rates point in the direction that there will not be a private takeover of Tigo any time soon. I think they are visualizing an extremely stable entity that can issue new bonds at good terms. Perhaps a combination with Tele2 would now instead make more sense and aid that goal? That way you can also eliminate double listing costs, the useless American listing, even more management layers and it could provide a faster way to unlock deferred tax assets. And mr Lombardini could review the costs at Tele2 when he is done with Tigo.

Even though they emphasized bond repurchases and the discounts help towards the deleveraging target, I would still expect them to find a way to make further stock buybacks in the coming months, if nothing major changes. Lati, other possible asset sales and some extra room against a conservative guidance should permit that.

On Iliad's and Xavier Niel's purchase of control in Tele2

I think the timing of the announcement of the Tele2 deal is not a complete coincidence. It has been unofficially for sale for a long time and officially since the chairman of Kinnevik "slipped up" a month ago or so and told Affärsvärlden. Either the chairman already knew they would sell and knew the buyer at that point or he was in far-along negotiations and tried to entice other possible buyers by his off-hand comment. So I think there is a strong possibility that Iliad wished for today specifically to be the announcement day. I don't think it's wise to elaborate further on that, but I wanted to state it for the record.

Strategically, it's interesting for all kinds of reasons. Tele2 is underleveraged and that will likely change. It opens up the possibility for M&A both in-market and in new markets. You can think of all kinds of permutations, both involving Niel's current business interests and possible new ones. Whatever happens structurally will have to satisfy criteria of capital efficiency and tax efficiency. Secondarily, I would of course assume that he has some view on the competitive vulnerabilities in Tele2's markets.