Millicom saga, phase 2

Xavier Niel goes above 20% and files a 13D with the SEC, stock still worth $40

Anyone who has been paying attention to the trading in Millicom (TIGO) shares lately noticed some unusual patterns on Friday. It was pretty easy to guess that Xavier Niel was back in the market buying. Friday evening a 13D was filed with the SEC, taking up the regulatory burden and disclosure needs a notch.

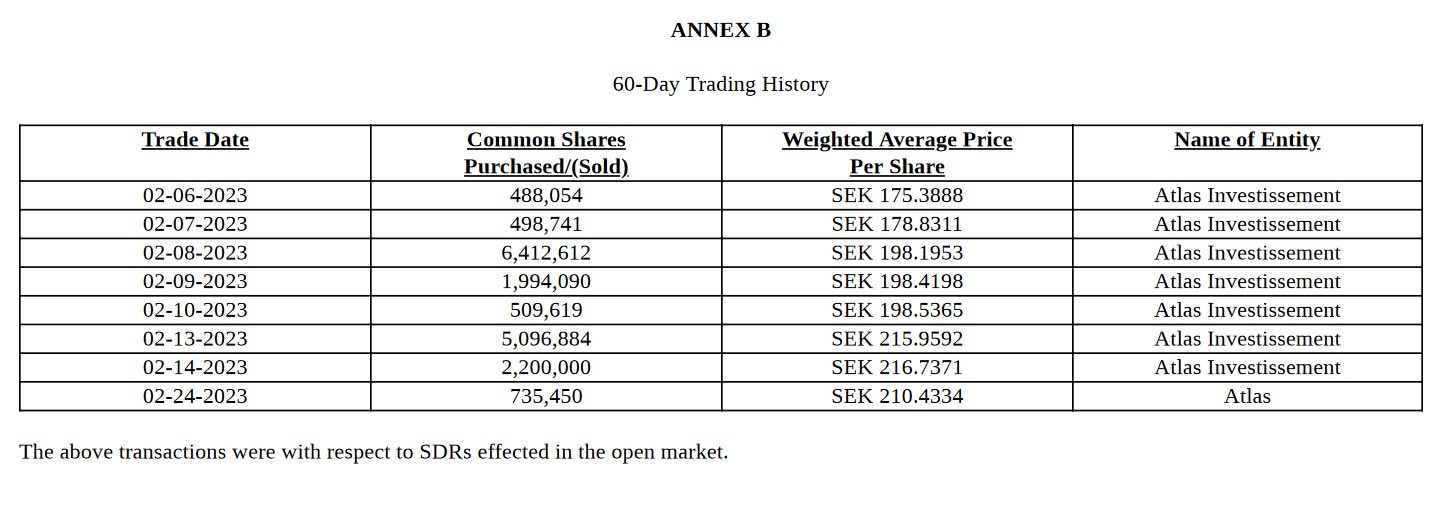

In the document, Niel’s recent trading history was revealed, which might be of interest:

Since these numbers sometimes way exceed the daily volume on the Stockholm exchange, it shows that suspicions of Niel buying heavily in dark pools were correct. My guess as to the reason why the tempo was so high is that after the shares from Atlas and Societe Generale were combined, Niel went above 10%. At that level, an American filing is required and afterwards continuous amendments at every 1% increment. So, before filing a 13G, they bought as many shares as they could, landing just shy of 20%, the threshold at which a 13D would have been required.

When Niel’s holdings were combined, they were transferred into a Luxembourg company, Atlas Luxco, which aligns their jurisdiction with Millicom. I think the idea here is to eventually go at least above 25%, which allows being classed as a beneficial owner, giving tax-free treatment to future dividends. This would fit in well with Xavier Niel’s modus operandi in Irish operator Eir, which I wrote a Twitter thread about:

A 13D has to contain financing for the purchaser, so we now know that Atlas Luxco has a number of banks who provide “up to” €450 million in loans. I can’t spot how much has been tapped at this point, but the collateral required is a pledging of Millicom shares, with a minimum of 30 million shares. However, from the perspective of capital efficiency, it wouldn’t make much sense to infuse the company with more cash than absolutely needed. Under the loan terms, the only activity that Luxco is allowed is the purchasing of Millicom shares.

In the event of a bid on Millicom, whether from Luxco or any other participant, this loan has a mandatory prepayment provision, meaning another means of financing will have to be arranged. That indicates that this loan arrangement almost takes on the form of a bridge loan until the point of a bid for the company. Either that or the share price rises significantly, making the LTV and collateral requirements unproblematic.

In the legalese of the document, Atlas is keeping all doors open with regards to merger talks or restructuring of the company. While this language probably means little in itself, it seems to indicate that Niel has not been involved in any direct or specific talks with the board of directors at this point in time.

I think the path of least resistance from here on is that Luxco keeps buying shares in the market for the time being. If that happens, we will notice relatively quickly because every 1% increment is to be reported in a 13D amendment within 2 days.

Millicom is an equity stub (meaning debt far exceeds market value in the enterprise value calculation) and Luxco itself is levered, so the share price volatility under normal trading conditions may prove to be problematic for Niel. Therefore, my guess as to how this will proceed is that as long as the share price doesn’t take off massively, Luxco will keeping buying shares and leaning on the share price upwards. Potentially this keeps up until Luxco approaches 1/3 of the shares, which is the mandatory bid level in Luxembourg. We know that he has been willing to pay up to about 220 SEK or $21 thus far. When the mandatory bid level is reached, I don’t think it makes sense to trigger it, since that would prolong the timeline, probably past the tower separation later this year. Instead, if vying to buy the entire company, I would expect a suitable premium bid which has the chance to win the favor of institutional owners.

If those share purchases from Luxco are finished well before the tower separation at Millicom, there will be a great window of opportunity to bid for the entire company. This can be done by Niel’s operating company Iliad or in cooperation with Apollo. We don’t really know how big Niel wants to ultimately go at this point. But it seems unlikely to me that Luxco itself will be the bidder.

Either way, at some point, Luxco will need an income stream from the shares in order to pay interest costs, meaning that in the event that Millicom stays public for longer, to the extent that Niel needs income, dividends will probably be favored over share buybacks in the future.

Now, I’m a dumb Swede and not used to reading and interpreting 13Ds, so if anyone with more experience spots something that I have missed, please reach out!

In short, my view of the short-term future is this: either the share prices rises quickly or Niel buys more shares or someone bids for the company. Since Niel chose to step above 20%, his intention must be to buy more shares, or the hassle wouldn’t be worth it. Consequently, any outcome besides those three seems unlikely. Exactly what happens in what order depends on a number of outside factors, so it is probably impossible to know.

Don’t forget that the stock is worth $40!

impressive detective work.

keep reminding all of the min. $40 value !

always a bit late, morningstar now has fair value at $30, but "more" if towers and fintech separated. shout out again to keith smith of bonhoeffer; has been the most judicious in covering this name the past few years.

Great part 2 update !! Just curious, why u reckon Niel was (is) buying the SDR (swedish depository receipt) instead of the US Nasdaq listed TIGO ?