I didn’t imagine that I would write anything more on this subject before something material had transpired. However, today I listened to Iliad’s Q4 conference call and some thoughts formed.

Earlier, I had envisioned a non-consolidated setup, where Iliad grabbed a piece, Niel grabbed a piece and maybe a third player took a stake too. This as a way of maximizing leverage and IRR. I was stuck on this because my chief concern was the change of control issue with Millicom’s bonds. However, that problem was pretty much sorted by the February update from Fitch.

At this point, I think there might be another logical solution. Iliad is an exceptionally well-performing telco asset with growth far in excess of European peers. Since Niel’s take-private transaction, they have been on a deleveraging journey, partly by separating infrastructure assets and partly from operating cash-flows. They are still not completely done with a 4.4x leverage and a short-term target of 4.0. The CEO also indicated on the call that they are looking to get down the leverage specifically at the holdco level by about half a turn. There doesn’t seem to be any immediate way to get this done, seeing as no big structural changes are imminent. But it could be done by getting their hands on some immediately monetizable assets. Do we know of any? Maybe some towers in Latin America worth about $1.5 billion?

On the topic of cross border synergies, the CEO expressed extreme bullishness on their worth. He said that they would be “pragmatic” on any deal within the limits of their financial constraints. This segues well into a natural deal alternative for a levered entity: an all or mostly stock merger. Those with a good memory will recall that this structure was explored pretty intensely between LILA and TIGO a couple of years ago. It was ultimately abandoned, reportedly because Mauricio Ramos said no. The rest is history with Kinnevik dumping all their shares and all the following woes.

A combination of Iliad and Millicom would now probably make even more sense, since operating synergies and profile weigh heavier than financial synergies. It could be structured as a reverse merger with Iliad re-entering the public markets, this time as a NYSE-listed entity. It doesn’t seem like a natural position for a company of Iliad’s size, bond market presence and an ongoing sell-side analyst coverage to stay private forever. Iliad’s blended leverage would be helped quite significantly. And the combined entity would have an attractive cash-flow profile. Additionally, if it gets done before the tower separation, it could help Iliad delever the holdco with an extraordinary dividend.

Another aspect it solves for — that it is harder to do with a cash deal — is management comp. Illustrated well in this tweet thread:

https://twitter.com/leonardo_1452_/status/1633200832928677889

A deal with a heavy stock component can be more generous on nominal price and thus not risk alienating management short-term and — combined with a continued public vehicle — enable smooth future equity compensation. This solves for a lot of potential issues with a cheapish and badly received cash takeover offer, both among employees and outside shareholders. And it potentially helps Iliad a lot. Two birds with one stone.

For current Millicom owners it also introduces optionality. Instead of getting forced out at a basement price, you can choose to roll your equity into the new company, which over time should have a fair bit of potential for multiple expansion.

The resulting company would be more of a peer of America Movil (albeit with higher leverage) than LILA, which from the perspective of the stock market is certainly a more flattering comparison. The combination of European and Latam assets injects more cashflow stability into the Millicom story and a future avenue for growth into Iliad. It also balances out the capex profile, since Iliad is now in a falling capex cycle while Millicom has topped out but are still on the heavier side.

Iliad has rigged themselves quite well with two very recent bond offerings and banking facilities of €5 billion last summer. The timing with Niel buying into Millicom’s equity raise and then later open market buys under the guise of SocGen does seem rather curious in retrospect.

Iliad’s CEO also stressed that they have rigged themselves deliberately with a lot of excess liquidity so as to be flexible in terms of opportunities. Latin America as the next market of course wouldn’t be the first guess if not for what Iliad’s owner has been up to lately, but all in all, the CEO struck me as someone ready to do M&A. Macro concerns were notably absent on the call.

But is a deal really possible in the current climate?

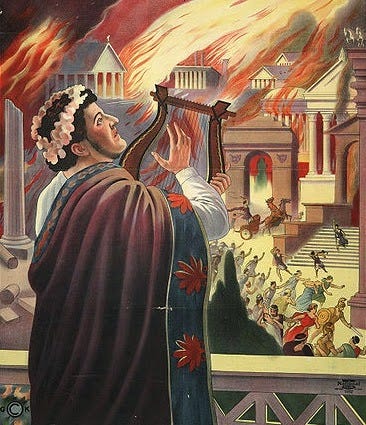

I don’t know. Am I fiddling while the market is having a meltdown? Are all deals off the table for the foreseeable future? I guess we will have to see. Now I will shut up until something actually happens. Probably.

Niel stepped over 20% (including treasury shares on the 15th, 13D was excluding). This filing has him with 250k more shares than what was known earlier. https://www.millicom.com/media/5497/atlas-luxco-sarl-major-holding-notification-20230317.pdf

This probably means that he has been buying shares throughout the week (settlement date on the 15th for shares bought on the 13th). And the trading today was likely influenced by heavy buying just before a filing went official, which has been the usual pattern.

Next up is SEC filings where we will likely see in more detailed ways exactly how many shares were bought in total. With potential darkpool trading probably up to a few percent of outstanding thus far, if we think he has been buying all week.

Did you see the notice of change in the nomination committee just now? Xavier has a guy on the committee now. What do you think that means for a takeover?

He seems to be from Iliad.

Thank you!