Since my last post, Xavier Niel first stepped over 20% in Luxembourg (including treasury shares). He was then invited to join the nomination committee (NC), raising the prospect of Atlas joining the board. This is curious timing, because Niel could have chosen to join the NC by his own volition at an earlier date (3 months in advance) and he could have also been invited by the NC earlier at any date in time. Note that Niel has been the by far largest shareholder publicly since September.

So why now? The work of the NC should have already been done two weeks ago by its usual timeline. And it’s now creeping up close on its legal deadline to call the AGM for the scheduled date of May 4. Really makes you think.

Last night, an SEC filing was made that Atlas stepped over 21%. From now on, the requirement is that Atlas report every 1 percent increment. I had suspected a few times earlier from the order flow that Niel was in the market for more shares, but it took a lot longer for him to accumulate the whole 1% than I had anticipated.

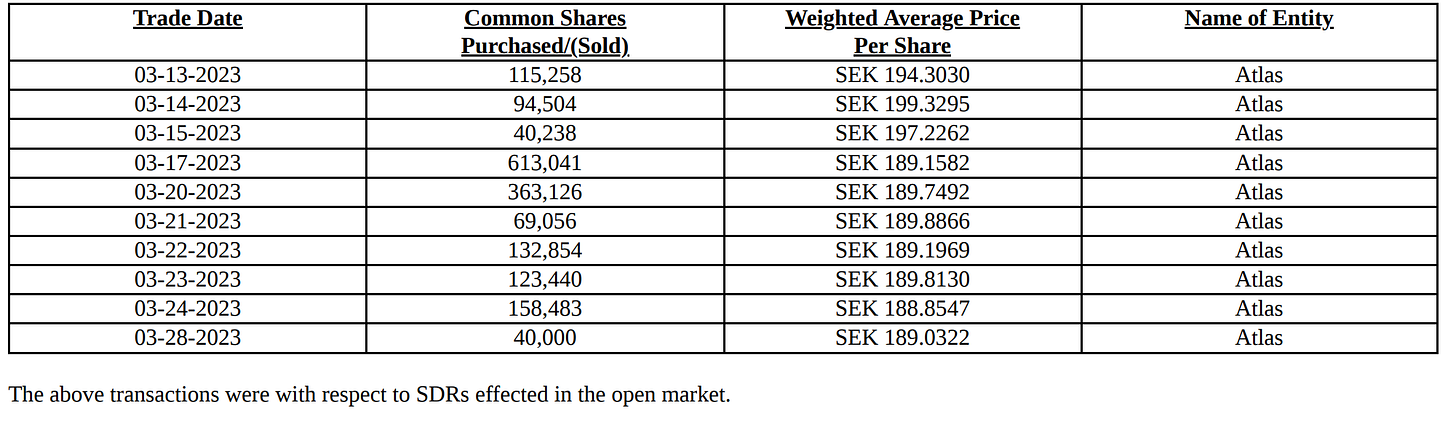

As seen from the listed trading history, the pace has not been overwhelmingly high overall:

But it’s no accident that I got extra suspicious on the heaviest trading day of March 17

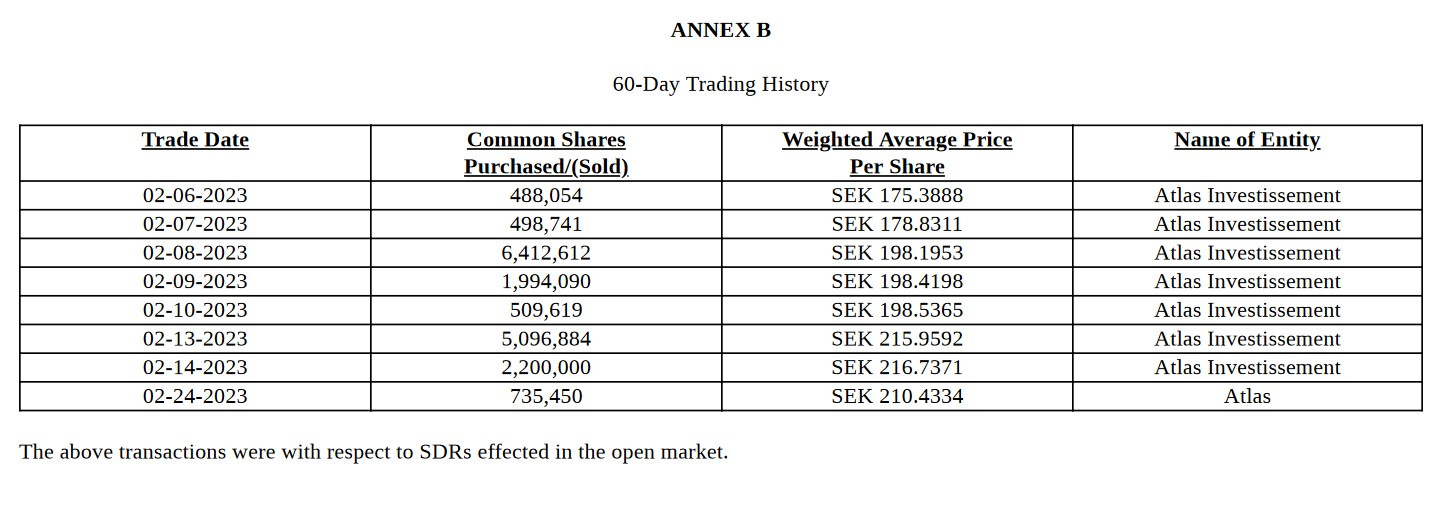

The overall pace of purchases can be compared to February, and you see a marked difference:

There is a curious absence of purchases from Feb 24 to March 13. As I have said over and over, it did not ever make any sense that Niel would be done at 20%, nor obviously does it now that he is at 21%. He wants more shares. The question is how to get them in the most efficient manner. So the obvious implication for the crazy conspiracy theorist is that something stopped him from buying shares from late February to mid-March. The natural thing to assume would be some kind of engagement with Millicom, likely to bid for the entire company.

After all, it will be harder to buy a lot of shares undetected now that the reporting requirements are more stringent and liquidity has dried up. But anyway, whatever happened then, nothing was settled on. And apparently it wasn’t at all considered to invite Niel to the NC at that point for some incomprehensible reason. Except… perhaps… there really was no point to consider the board yet when there was a bid on the table.

So back to today. Now, the NC has invited Niel and Niel is back buying shares over the market. Obviously, there can’t be currently ongoing negotiations for a takeover while Niel is in the market. But that doesn’t at all preclude the possibility that a bid might emerge.

This time, he is slower with the buying and doesn’t want to push the price upwards if he can help it. The pace is too slow to help him accumulate the total amount of shares that he should be interested in having in reasonable timeframe. But it does mark his presence to counterparties and it also helps keep the shares range bound, thus avoiding triggering the need for additional equity in Atlas. It may also demonstrate to the board that the moment a deal is permanently off the table or Niel exits the market for shares, there is some downside left in the price. This is helpful if, say, you have previously ended price negotiations because you couldn’t meet in the middle.

As this is going on, the clock is ticking for the AGM. Maybe it won’t be held on May 4 ultimately, but it at least has to be held in H1. As time marches on, the incentives from both sides for making a deal increases. If no deal is reached and Niel enters the board, a few board members risk being out on the street. And management, who tried negotiating a competing deal with Apollo right under the nose of Niel, can’t be at all sure of their future if whatever happens from now until Niel takes the reins greatly displeases him.

Meanwhile, from a purely fiduciary perspective, the current board has to weigh the upside of getting a deal now for the minority versus potentially being taking advantaged of by a new owner.

Perhaps the late invitation to the NC was a desperate stalling tactic or it was just a way of pre-empting a coup at the AGM. No matter, Niel’s presence on the NC, through the CFO of Iliad, does represent something of a threat in a — for the moment — quiet negotiation game. But on the other hand, Niel probably doesn’t really want to join the board before he has a much larger ownership in the company. It only complicates things, exposes him to trading windows and insider information that he doesn’t currently want. Too restricting right now.

So nobody has yet veered away in this game of chicken. But somebody probably will. The board question will need a resolution. If Niel stays on the outside, prepare for more aggressive market purchases or even potentially a hostile bid. If he proposes board members, the incentives to reach a mutual deal for the entire company increases before the AGM. And meanwhile, the tower separation process is chugging along and the management has great reasons to highlight other strengths of the business in the upcoming quarters.

In the interim, it does seem really stupid to let go of your shares when there is a buyer in the market who likely doesn’t even want the shares to fall too much due to his financing. Perhaps you won’t get that juicy premium bid tomorrow, but what — really — is the downside here? The risk/reward from an event perspective seems extremely skewed to the upside. When the stock crashed down towards 180 SEK, Niel entered the market bigly, being the new king of debt and negotitation genius, and pushed the stock up to 189 again.

Of course, it’s possible that he injects more equity into Atlas and tolerates more volatility, but this would hurt the IRR and it does seem kind of pointless to save a few percent on price on a tiny percent of shares if the idea is to eventually do a complete takeover.

And as you know, I have argued for an ultimate $40 price tag. So the value fundamentalist can just safely ignore all these speculations and intricacies and HODL.

if we HODLr's get murdered, this here is some upcoming season of CSI, Forensic Securites Squad.

Thanks for your good and professional work - Will HODL to 40$